With the ever-changing market, people are wondering how inflation and interest rate hikes will impact real estate- and for our investors, how these changes will impact the vacation rental market specifically. Here is what we are seeing from both a property performance and acquisition perspective.

Property Performance

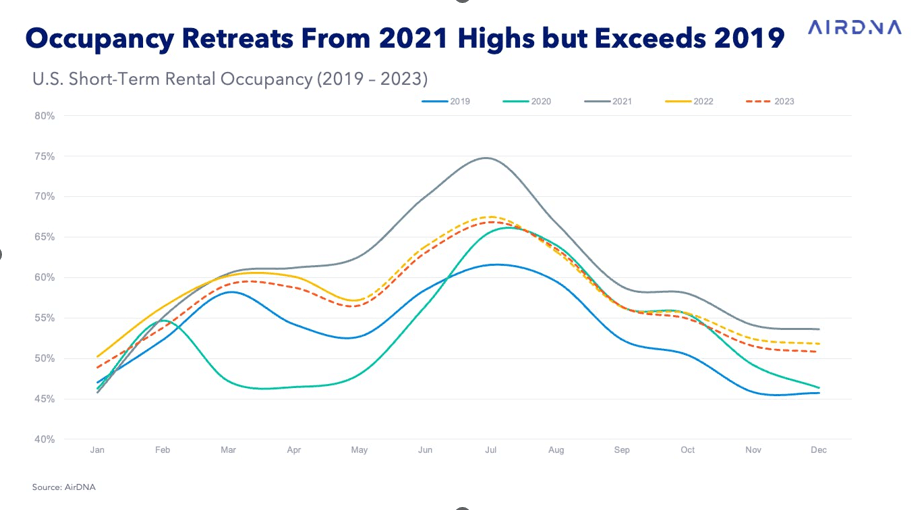

We have long anticipated occupancy rates to decline from the high 2021 numbers we saw due to covid revenge travel. While our summer months have remained strong as people seem to be following through with their planned vacations, we have started to see a decrease in occupancy as we head into the fall. This trend aligns with what Airdna reported in their most recent market update showing that occupancy rates across the industry have declined from 2021 but are still well above pre-covid numbers in 2019[1].

We are encouraged to see from the same report that market rates are holding strong with the Average Daily Rates up 6.3% and RevPAR up 2.1% compared to 2021. As most of our properties are too new to compare 12 months of operating data, we see a similar trend with daily rates holding strong and we still expect to hit our annual revenue projections.

Even with the changing environment, we don’t anticipate travel to go away. In fact, we expect accessible destinations (within driving distance for many) to continue to see demand as people will likely cut air travel in exchange for visiting more drivable destinations. In addition, larger homes should continue to see demand as families will look for homes they can split with 2-3 other families, which our properties are positioned well for.

Acquisitions

On the acquisition side, interest rate hikes are starting to slow down the abnormal price increases as we’re now seeing longer days on market, bidding wars slowly going away, and slight price decreases depending on the market. We don’t expect to see a major drop in prices but anticipate buying opportunities to be more abundant than they have been in the competitive real estate environment we’ve seen over the last few years.

We believe this changing environment will spawn new opportunities in the space. In the event we trend further toward a recession, we plan to turn on the burners and pursue opportunities many others will shy away from. We have worked hard behind the scenes to identify new markets and strategies that will provide us and our investors with outsized returns. They say the most wealth is created coming out of a recession, we fully expect to participate and hope you’ll join us as opportunities become available.

-Loma Homes Management

[1] https://www.airdna.co/blog/2022-mid-year-short-term-rental-outlook